(COLA, Tax Caps, WEP/GPO Repeal & More Updates)

Introduction: Why 2025 Is a Big Year for Social Security

If you’re receiving Social Security — or planning to soon — 2025 brings important updates that could impact your monthly benefits, taxes, and eligibility. From a new cost-of-living adjustment (COLA) to a higher taxable earnings cap, these changes are designed to keep the program sustainable while adapting to inflation and demographic shifts.

This guide breaks down all confirmed What Changes Are Coming To Social Security In 2025 and expected changes in simple terms — so you can understand how they affect your retirement income, disability benefits, or spousal payments.

💡 Quick Takeaway: Most beneficiaries will see a COLA increase in 2025, while higher earners will pay Social Security taxes on more income (up to $176,100). Some retirees could also benefit from possible legislative updates to the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) rules.

The 2025 Cost-of-Living Adjustment (COLA)

1.1 Confirmed COLA 2025

Every year, Social Security payments rise (or occasionally stay flat) based on inflation. For 2025, experts estimate a COLA increase of around 3.2%, depending on the final inflation data from the Consumer Price Index for Urban Wage Earners (CPI-W).

That means:

- If your monthly benefit is $1,800, a 3.2% COLA adds about $58 more per month.

- The average retired worker’s check will increase to approximately $1,858 starting January 2025.

🧮 Why it matters: COLA ensures your purchasing power keeps pace with inflation — especially crucial for retirees on fixed incomes.

Related Resource: Social Security COLA Calculator 2025 – Estimate Your New Benefit

1.2 Forecast: 2026 COLA

While not finalized, analysts estimate a 2026 COLA in the 2.4% to 2.7% range, depending on inflation trends. Some forecasts point toward 2.7% as a plausible figure.

- This estimate assumes continued moderate inflation and stable consumer prices.

- If the SSA transitions to CPI-E (Consumer Price Index for the Elderly) by December 2026, you might see slightly higher COLA adjustments because CPI-E more closely matches costs older adults face (healthcare, housing).

Social Security Payment Schedule & 2025 / 2026 Dates

1.1 2025 Payment Timing

Benefit payments are distributed mid-month depending on your birth date:

- Born 1–10 → 2nd Wednesday

- Born 11–20 → 3rd Wednesday

- Born 21–31 → 4th Wednesday

SSI payments often arrive earlier in the month. (SSA official schedule)

1.2 2026 Schedule Preview

SSA publishes a 2026 benefit calendar PDF ahead of time, so recipients can plan around holidays, banking delays, or personal financial cycles.

You can view both 2025 and 2026 schedules on SSA’s website under “Benefit Payment Schedules.”

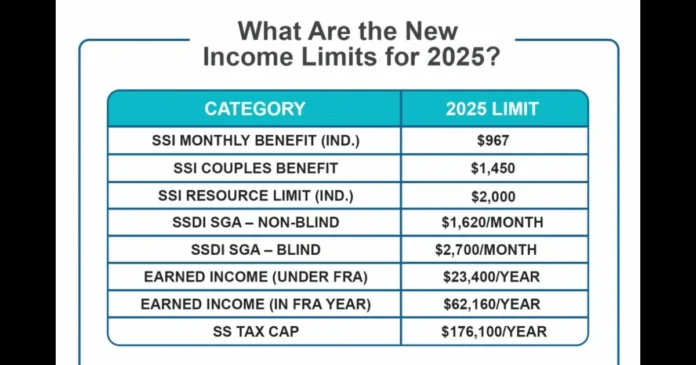

The Social Security Taxable Maximum Cap ($176,100)

In 2025, the maximum amount of earnings subject to Social Security tax will increase from $168,600 (2024) to an estimated $176,100.

That means:

- Workers earning above $176,100 will not pay Social Security taxes on income beyond that threshold.

- However, higher earners will contribute more in taxes overall, since the cap has risen.

| Year | Taxable Maximum | Increase |

| 2023 | $160,200 | — |

| 2024 | $168,600 | +$8,400 |

| 2025 (est.) | $176,100 | + $7,500 |

This change supports the long-term solvency of Social Security, which is facing funding challenges as more Baby Boomers retire.

3. Adjusted Earnings Limits for Early Retirees

If you claim Social Security before your full retirement age (FRA), your benefits may be temporarily reduced if you keep working.

For 2025, the earnings test limit is expected to rise:

- Under FRA for all of 2025: $23,400 (up from $22,320 in 2024)

- Year you reach FRA: $63,600 (up from $59,520)

💡 Example:

If you earn more than $23,400 in 2025 while receiving benefits early, your payments will be reduced by $1 for every $2 earned above the limit.

Supplemental Security Income (SSI) Payment Increases

SSI — the program that helps low-income seniors and people with disabilities — will also get a 3.2% COLA boost in 2025.

New 2025 SSI monthly payment rates:

- Individuals: $959/month (up from $932 in 2024)

- Couples: $1,439/month (up from $1,391)

These increases automatically adjust every January to protect beneficiaries from rising living costs.

Tip: You can check your updated SSI payment schedule here: Social Security Payment Dates 2025 – Full Calendar

Disability (SSDI) Changes & SGA Thresholds

Disability beneficiaries also benefit from many of the changes above, especially the COLA boost. Beyond that:

- SSDI beneficiaries receive the same 2.5% COLA in 2025

- The Substantial Gainful Activity (SGA) limit (non-blind) is set at $1,620/month in 2025

- For blind individuals, SGA rises to $2,700/month

- In 2026, SGA thresholds are expected to rise further in line with national wage trends, though official numbers are not yet published

Increasing the SGA helps ensure beneficiaries aren’t unfairly penalized for modest earnings.

Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) Reform

Congress continues to debate repealing or reforming the WEP and GPO rules, which reduce Social Security benefits for workers who also receive a pension from non-covered government jobs (like teachers or police officers).

As of late 2024:

- The “Social Security Fairness Act” (H.R. 82) has strong bipartisan support.

- If passed in 2025, millions of public-sector retirees could see restored benefits.

Until official changes are confirmed, these rules remain in effect — but momentum for repeal is growing.

Related Reading: Who Benefits from the WEP Repeal in 2025? Full Breakdown

Expanded Retroactive Benefits and Administrative Improvements

The Social Security Administration (SSA) is also updating its systems to make claims more user-friendly and digitally accessible.

Key improvements expected in 2025:

- Online retirement applications will be faster and clearer.

- Retroactive benefits (for those applying late) could be processed more efficiently, reducing delays.

- SSA’s new digital identity verification system will help prevent fraud and streamline authentication.

These changes reflect SSA’s ongoing modernization efforts to support the program’s 70+ million beneficiaries more efficiently.

Visualizing Growth — 2025 Increase Chart + Trends

Here’s a sample data chart to illustrate how 2025 fits into broader trends:

| Year | COLA (%) | Max Taxable Income | Avg Retired Benefit Estimate* |

| 2022 | 5.9% | $147,000 | $1,700 |

| 2023 | 8.7% | $160,200 | $1,820 |

| 2024 | 3.2% | $168,600 | $1,900 |

| 2025 | 2.5% | $176,100 | ~$1,950 |

*Estimate based on average benefit growth rates and historical data.

This visual helps users see how 2025’s changes compare to recent years.

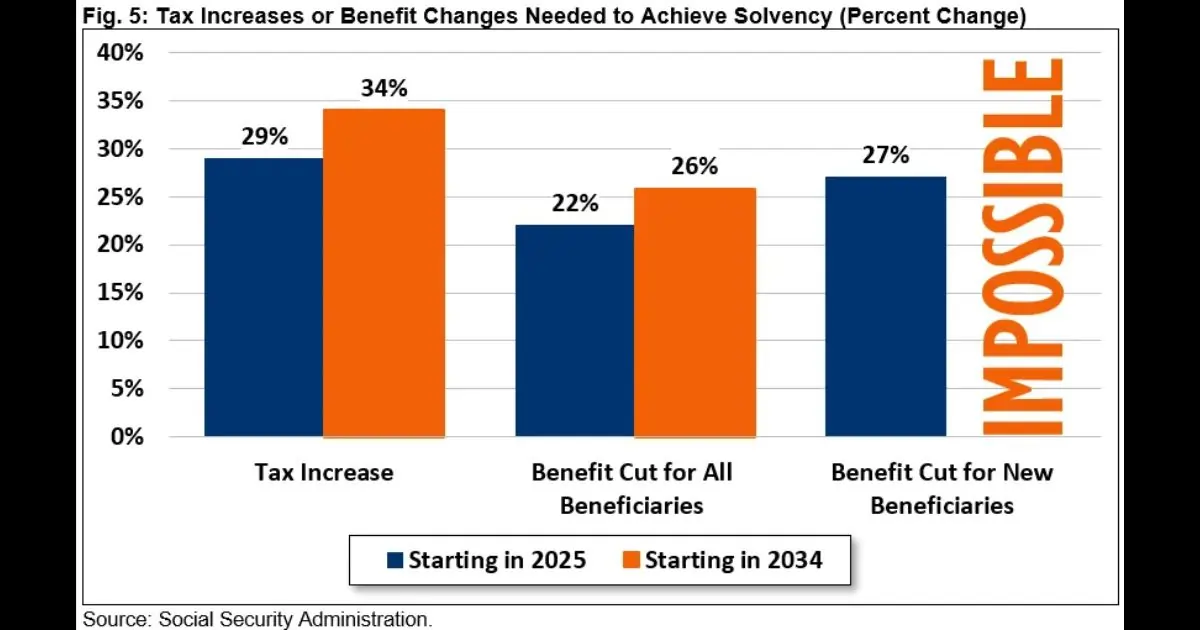

What About Social Security Solvency and Trust Fund Concerns?

The Social Security Trust Fund is projected to become insolvent by 2033–2035 unless Congress acts.

This doesn’t mean benefits disappear — but it would result in an estimated 20–25% cut in future payments.

Experts recommend:

- Gradual payroll tax increases

- Adjusting the full retirement age

- Possible means testing for high-income retirees

Fact: According to the SSA’s 2024 Trustees Report, the combined trust funds will be able to pay 100% of scheduled benefits through 2034, and about 80% thereafter.

How to Prepare for Social Security Changes in 2025

Here’s how to stay ahead of the curve:

- Check your Social Security statement at SSA.gov/myaccount.

- Use a retirement estimator to see how COLA and tax changes impact your future checks.

- Review your income sources — Social Security should ideally make up 30–40% of your total retirement plan.

- Stay updated on legislative changes, especially WEP/GPO and benefit eligibility.

💬 Pro Tip: Consider speaking with a financial advisor who specializes in Social Security strategies for retirees. They can help maximize your lifetime benefits.

What to Watch for in 2026 and Beyond

Looking ahead, key possible changes include:

- Transition from CPI-W to CPI-E: If implemented, future COLAs may more closely reflect the spending patterns of older Americans.

- Expanded benefit formulas: Some proposals suggest extra COLA boosts for long-term retirees or adjustments to benefit calculation methods.

- Means testing for high-income retirees: Though not confirmed, some legislative ideas propose scaling benefits for high earners.

- Further increases in SGA or taxable cap consistent with wage growth.

These potential changes could reshape how Social Security serves future generations. Stay updated via SSA announcements and trustworthy news sources.

How to Use This Information: Planning Checklist

| Action | Why It Matters | Resource |

| Check your 2025 benefit estimate on MySocialSecurity | Know what your benefits will look like | SSA.gov/myaccount |

| Use a COLA calculator | See the actual impact for your specific benefit | Our 2025 COLA Calculator |

| Review your SSDI status & SGA limits | If you work part-time while disabled, ensure compliance | SSA SSDI rules |

| Monitor WEP/GPO repeal developments | Public employees may benefit immediately | SSA / Congressional updates |

| Plan for Medicare premiums | Premium increases will offset part of your COLA gain | Medicare.gov |

Conclusion: What Changes Are Coming To Social Security In 2025

The year 2025 marks another pivotal point for Social Security — with higher benefit payments, increased tax thresholds, and potential legislative reforms that could reshape retirement income for millions.

While these updates bring some relief against inflation, they also highlight the need for personal financial planning and continued reform to protect future generations.

🎯 Take Action Now:

Use the 2025 Social Security COLA Calculator to see how your benefits will change — and plan smarter for the year ahead.

Read Also:

- Renters Insurance: Protect Your Belongings and Peace of Mind

- Masari Cabal | The Financial Social Network Designed for Traders & Investors

- ImmoScout | 15 Powerful Facts You Can’t Afford to Miss

- 1262.76 of 4536.00 Is What Percent? | Calculate the Percentage

- How to Calculate YOY (Year Over Year) Growth for 3 Years (Step-by-Step Guide) 2025