As of July 1, 2025, PaycheckCity remains one of the most trusted and widely used online platforms for calculating accurate paychecks. With updated federal and state tax data for 2025, PaycheckCity offers a powerful suite of free tools that help employees, freelancers, and employers estimate net pay after taxes and deductions.

Whether you’re paid hourly, salary, per project, or receive bonuses, PaycheckCity allows you to simulate your take-home pay with precision—factoring in everything from W-4 adjustments to state-specific tax rules. It’s particularly useful for:

- Double-checking payroll accuracy

- Planning job changes across states

- Understanding the impact of deductions

- Estimating bonus pay or gross-ups

In an economy where every dollar matters, PaycheckCity helps you see exactly what you’ll take home—before the paycheck hits your account.

Who Owns or Founded PaycheckCity?

PaycheckCity is owned and operated by Symmetry Software, a trusted payroll technology company based in Scottsdale, Arizona. The company was founded by Tom Reahard in 1984, with the goal of making payroll tax calculations easier for businesses and individuals.

Symmetry Software specializes in:

- Payroll tax APIs

- Withholding compliance tools

- Paycheck modeling solutions (like PaycheckCity)

Interesting Fact:

Symmetry’s tools are used by many HR platforms, accounting firms, and even Fortune 500 companies for backend payroll accuracy. PaycheckCity is their public-facing free tool for individual users.

🛡️ Why this matters:

Knowing that PaycheckCity is backed by a 40-year-old payroll tech company—not just a random online calculator—adds credibility and confidence for users who depend on its accuracy.

Why PaycheckCity Matters More Than Ever in 2025

With the IRS updating W-4 forms and income tax brackets annually, employees can no longer rely on guesswork. PaycheckCity makes this complexity simple by updating its calculators in real time to reflect current federal and state tax laws.

Why it matters:

- You could be underpaid or overtaxed without knowing

- Many employers won’t explain your deductions line-by-line

- If you freelance or have side gigs, tax estimation becomes critical

PaycheckCity helps with all of the above. It’s not a replacement for a CPA or tax filing software—but it’s an indispensable planning tool.

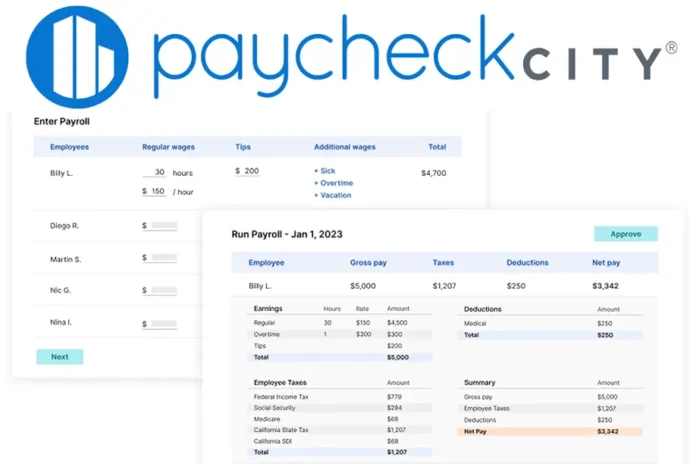

A Breakdown of PaycheckCity’s Core Calculators

PaycheckCity offers a wide range of calculators—each tailored to a specific employment situation. Let’s break them down:

1. 🧾 Salary Paycheck Calculator

This tool is designed for employees who are paid a fixed salary per year.

Key Inputs:

- Gross annual salary or per-pay-period amount

- Pay frequency (weekly, biweekly, monthly, etc.)

- Federal filing status (single, married, head of household)

- Number of dependents

- Pre-tax deductions (401(k), HSA)

- Post-tax deductions

- State of residence or employment

Outputs:

- Total gross pay

- Breakdown of taxes: federal income tax, Social Security, Medicare

- State and local taxes

- Net take-home pay

✅ Use Case: Planning whether a $72,000 job in California will net you more than a $68,000 job in Texas.

2. ⏰ Hourly Paycheck Calculator

Perfect for workers paid by the hour, with optional support for overtime and shift differentials.

Key Inputs:

- Hourly wage(s)

- Regular, overtime, and additional hour types

- Pay frequency

- State of employment

- W-4 info and deductions

Outputs:

- Gross pay based on entered hours

- Tax breakdown

- Take-home pay

✅ Use Case: Restaurant or gig workers who have inconsistent schedules and want to estimate their next paycheck.

3. 💸 Bonus Paycheck Calculator

Bonuses are taxed differently than regular wages—PaycheckCity lets you calculate your post-tax bonus two ways:

- Percentage Method (Flat Rate): Uses the IRS’s 22% flat tax rate for supplemental income.

- Aggregate Method: Combines the bonus with regular pay and taxes at the employee’s normal rate.

Outputs:

- Estimated net bonus after taxes

- Full tax breakdown

✅ Use Case: You’re expecting a $5,000 annual bonus and want to know if you’ll actually receive $3,900 or less.

4. 📊 Dual Scenario Calculator

This lets you compare two different pay scenarios side-by-side.

Inputs for Both Sides:

- Gross income

- Tax settings and deductions

- Pay frequency

Outputs:

- Two complete paycheck breakdowns

- Difference in net pay, taxes, and take-home

✅ Use Case: Choosing between two job offers with different pay structures or between biweekly vs monthly pay periods.

5. 🎁 Gross-Up Calculator

Ever wonder how much an employer needs to give you so that you net a specific amount after taxes? That’s what this calculator does.

Inputs:

- Desired net pay (e.g., $1,000 holiday gift)

- Pay frequency

- State and W-4 info

Output:

- Required gross amount

- Taxes and deductions automatically calculated

✅ Use Case: A company wants to issue a “net” cash bonus or cover relocation costs.

State-by-State Calculators

PaycheckCity offers dedicated calculators for every U.S. state, factoring in:

- State income tax rates

- Local/city tax codes

- Unique deductions (e.g., SDI in California, NYC tax in NY)

✅ Use Case: Comparing take-home pay in Illinois vs Florida (which has no state income tax).

How Accurate is PaycheckCity?

PaycheckCity is operated by Symmetry Software, a reputable payroll solutions provider trusted by thousands of HR departments and companies across the U.S.

- Updated yearly with IRS and state-specific tables

- Includes current 2025 tax brackets and deductions

- Used by both employees and payroll professionals

While it’s not a tax preparation tool like TurboTax, it’s accurate for paycheck forecasting.

Step-by-Step Example (Using the Salary Calculator)

Let’s walk through a real scenario:

Scenario:

- Annual Salary: $85,000

- Pay Frequency: Biweekly

- Filing Status: Single

- State: New York

- Pre-tax deductions: $150 (401k), $100 (HSA)

- No post-tax deductions

Result:

- Gross Biweekly Pay: $3,269.23

- Federal Tax: $365

- Social Security: $202.27

- Medicare: $47.40

- State Tax: $125

- Net Pay: ~$2,429

This lets you plan your budget, savings, and expenses accurately—especially useful for rent-heavy areas like NYC or LA.

Common Pitfalls to Avoid

Ignoring W-4 changes:

The new W-4 form introduced in 2020 eliminated withholding allowances. If you haven’t updated yours, your paycheck calculation may be off.Leaving out deductions:

Forgetting to include 401(k), HSA, FSA, or post-tax items like insurance can significantly skew your results.Choosing wrong pay frequency:

Biweekly ≠ Semi-monthly. Make sure to choose the correct schedule—your net per paycheck could change.Misunderstanding gross vs net:

Gross is your full salary. Net is what actually hits your account. PaycheckCity helps bridge that gap.

PaycheckCity vs Other Calculators

| Feature | PaycheckCity | SmartAsset | ADP | IRS Withholding Estimator |

|---|---|---|---|---|

| Free to use | ✅ | ✅ | ❌ | ✅ |

| Bonus calculation | ✅ | ❌ | ❌ | ❌ |

| Gross-up calculator | ✅ | ❌ | ❌ | ❌ |

| Dual pay comparison | ✅ | ❌ | ❌ | ❌ |

| Mobile friendly | ✅ | ✅ | ✅ | ✅ |

✅ PaycheckCity stands out for its tool variety and simplicity, especially for HR and compensation planning.

How to Contact PaycheckCity or Symmetry Software

If you have technical questions, feedback, or want to explore enterprise payroll tools, you can contact the team behind PaycheckCity:

🏢 Company Name:

Symmetry Software – Creators of PaycheckCity

📬 Mailing Address:

Symmetry Software

14350 N 87th St Suite 110

Scottsdale, AZ 85260

United States

📧 Email:

General Inquiries: support@symmetry.com

Sales/Enterprise Tools: sales@symmetry.com

🌐 Website:

https://www.symmetry.com

https://www.paycheckcity.com

🕑 Support Hours:

Typically Monday–Friday, 9 AM – 5 PM MST (Arizona Time)

FAQs About PaycheckCity

Q1: Is PaycheckCity really free to use?

Yes. All calculators are publicly available with no login required.

Q2: Can I save or print results?

Yes. You can export or print the calculation for recordkeeping.

Q3: Does it support freelance income?

Indirectly yes—you can enter income values and treat them as gross. However, self-employment tax isn’t broken out separately.

Q4: Does it consider state-specific disability or local taxes?

Yes. It includes SDI (e.g., in CA, NJ), local taxes (e.g., NYC, Philly).

Final Thoughts: Should You Use PaycheckCity?

If you’re:

- Evaluating a new job offer

- Estimating freelance income after taxes

- Calculating take-home from a bonus

- Planning a gross-up payment

Simply curious how much you’ll actually earn

Then PaycheckCity is an excellent, free tool that gives you quick, clear answers in under a minute.

It won’t file your taxes, but it helps you understand them.

Also read these article: